The big themes we’ve examined – the megatrends reshaping consumer habits, the data-driven, influencer-heavy marketing – can often be seen in the UK market. And that’s where our country spotlight lands this year.

Consumer Trends and Market Dynamics in the UK Seafood Market

Chapter 5: UK SpotlightTaking It In-House

What would you do to save on food costs? If you’re a Brit trying to manage finances in an ongoing cost-of-living crisis – albeit one that has eased somewhat – it’s likely that you have been both cooking at home more often and eating out at restaurants less often.

That’s according to the NSC’s UK Deep Dive 2024, which gives you an in-depth view into the consumer habits of the UK. According to that research, conducted by Ipsos on behalf of the NSC, 40% of consumers are cooking more at home in a bid to keep costs down.

Some 28% say they eat out less often than before. Taste is key of course but health is also an important factor – though notably more so for salmon than cod.

Home Cooking and Health Trends

Eating at home and a focus on health are trends that come easily on the back of the pandemic but they’re also trends that impact seafood. As Victoria Braathen, the NSC’s UK director points out, almost three quarters of all seafood in the UK is bought and consumed through retail.

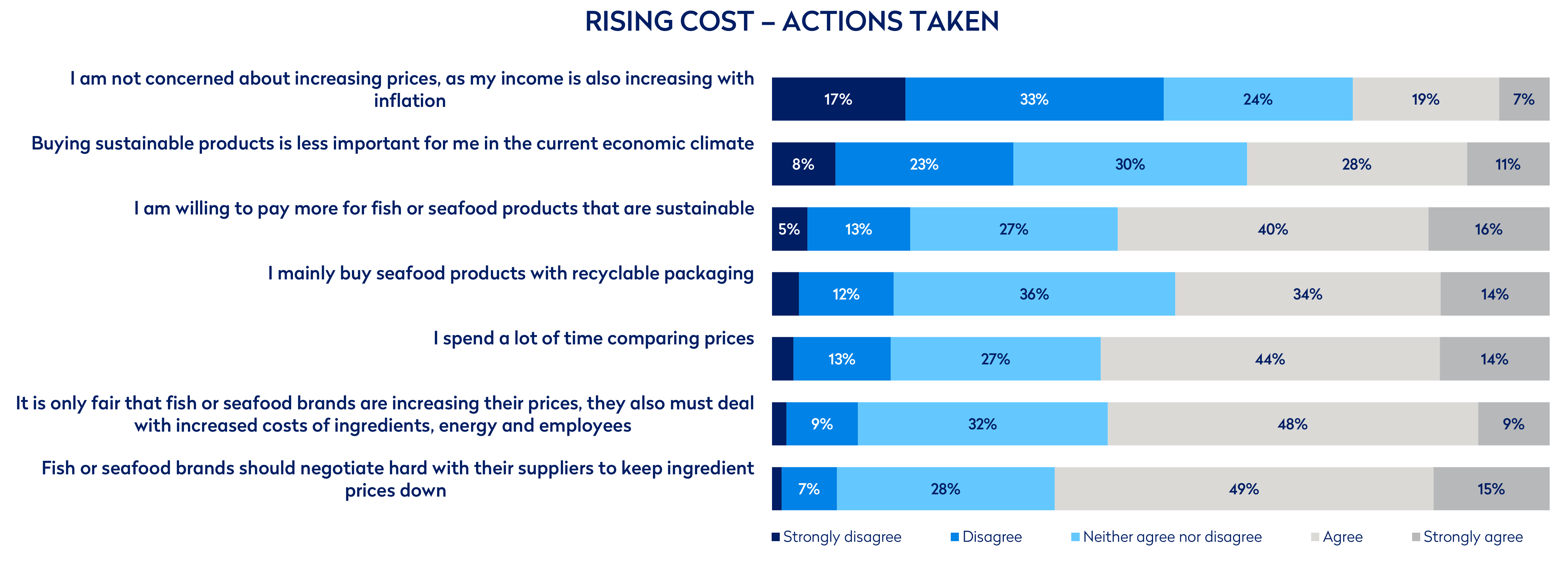

As more people eat at home, that figure could well rise. Still, consumers are certainly feeling the pinch and the Deep Dive research finds that most (64%) agreed or strongly agreed that fish and seafood brands should negotiate with suppliers to keep ingredient prices down.

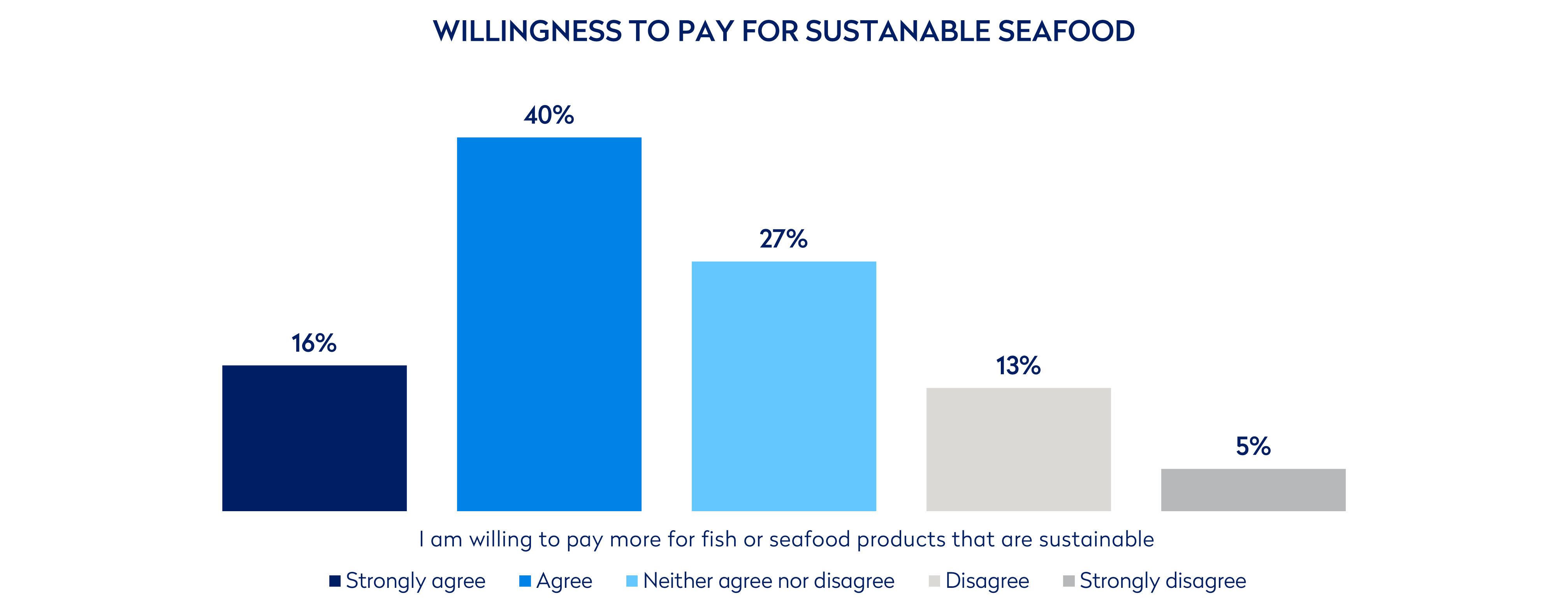

You might assume that this focus on cost, weighed up against other factors that matter to UK consumers, would shift the spotlight away from sustainability but it appears that that has not happened. More than half (56%) of consumers continue to say they are willing to pay more for sustainable fish and seafood products.

There was also a notable decrease in consumers saying that sustainability has become less important to them in the current economic climate. In 2023, 44% of respondents said sustainability had become less important to them in the current economic climate. In the 2024 survey, that figure drops to 39%.

A Tale of Two Fish

Looking at how people shop and buy for home consumption, salmon holds an easy position in the British kitchen, offering a healthy, quick meal. Today, some 50% of respondents to the 2024 survey report eating salmon at least once a week, with most buying fresh (66%).

Salmon most often occupies the main-character role at dinner (52%) and consumers talk about buying salmon because it is healthy, but it is also associated with family meals, relaxation and a ‘sense of enjoyment.’ This is a shift away from the rarer luxury salmon once was: it is clearly now a firm family regular.

Cod as the Top Choice

Cod is perhaps the more traditional choice – given its place in the classic fish and chips dinner. And it remains a top choice in the home too with 56% of respondents saying they eat it at home at least once a week. Here though, frozen cod tipped fresh to the plate – likely because of cost as well as convenience.

Just over half (51%) of consumers described frozen as their go-to, compared to 40% who said fresh. Like salmon, cod offers a healthy option, with consumers also noting a ‘sense of enjoyment’ and ‘an intense taste experience’ – as well as cod’s ability to please all palates.

Salmon on Wednesday

Interestingly, most (28%) at-home salmon meals happened on a Wednesday – the hump of the week when most people will be looking for something quick to throw together. Cod, on the other hand, hits its peak on a Friday (25%), indicating more of a treat meal.

Across both species there is a flexibility when it comes to buying branded as well as unbranded products – 39% say they buy both when it comes to salmon; 41% for cod. But among cod consumers, there is a clear preference for branded products (25%), with the associated value add, over unbranded (12%) – something that is less prevalent when it comes to salmon.

What Sustainability Means

There is a lot of discussion these days about what sustainable means – and some consumers are certainly confused. According to Ecotone research published in The Grocer, one in seven people believe there is no clear definition of what is ‘sustainable food’ – something that also applies to seafood.

Is farmed fish more sustainable because it allows wild stocks to stabilise? Does fish have to be local for it to be sustainable? Where does organic come into the mix? As a consumer, how do you weigh up environmental factors against your own health concerns?

Consumer Shopping

With all this in mind, it is interesting to look at how consumers are shopping around sustainable seafood.

This year, the NSC finds that there has been a 6-percentage-point increase in the number of consumers saying they are willing to pay more for sustainable fish and seafood products, a figure that now stands at 56%. At the same time, there has been a 5-percentage-point drop in those saying that buying sustainable is less important given financial constraints.

When researchers looked at how consumers are tackling the ongoing cost-of-living crisis, various solutions were offered – including buying fewer organic or sustainable fish and seafood products that may carry a premium. This is not a popular choice: just 10% of consumers saying they would do this to save money.

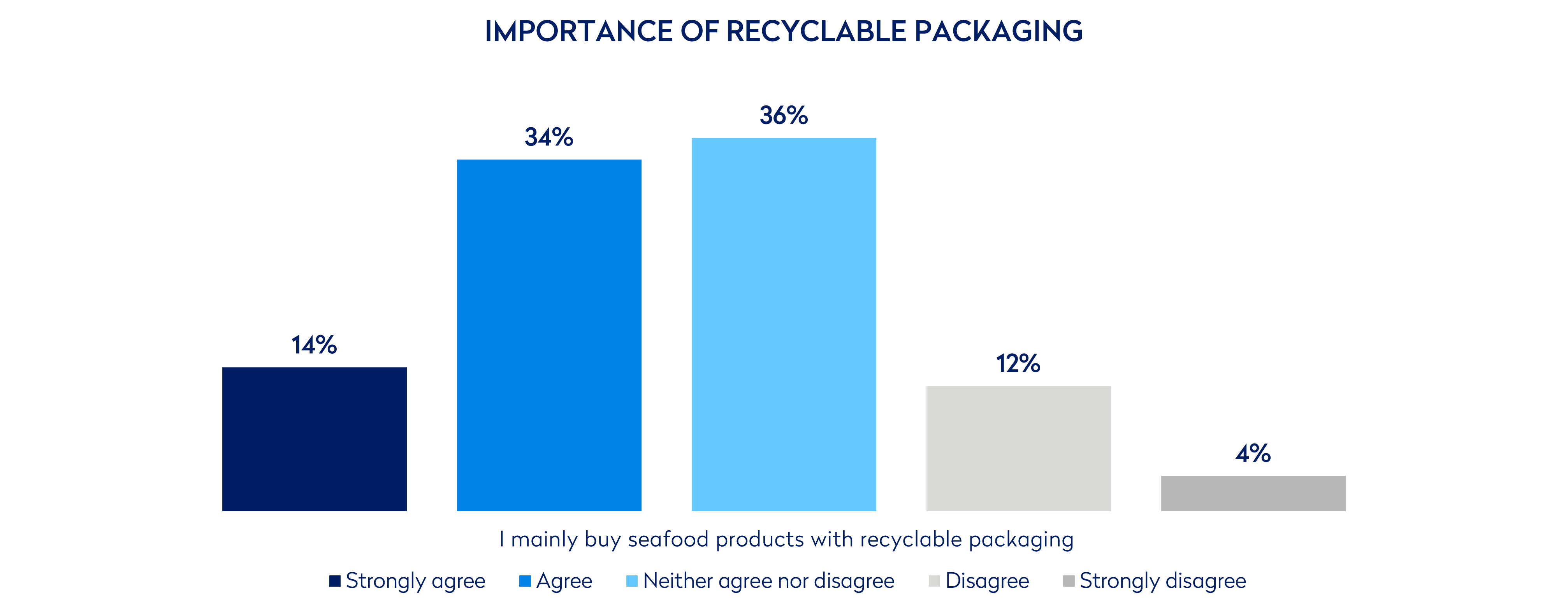

So it seems sustainability is here to stay. But do these figures translate into consumers actively seeking out certified sustainable products? Not necessarily – and it’s not as simple as that.

Just 19% say they do this for either cod or salmon, though researchers also asked about factors such as environmentally friendly packaging, whether the product was caught or produced in an environmentally friendly way, whether it was wild caught or farmed. All these questions and more make up the consumer idea of what sustainability is – highlighting an industry need for clarity and education.

Buy Norwegian

What does all this mean for Norwegian seafood producers? When it comes to the UK market, where there is also a slant towards buying local, consumers are increasingly willing to spend more to buy sustainable.

What that actually means can vary but in the confusion, there is an opportunity to drive clarity, to educate and to build brand recognition based on the issues that matter to fish and seafood consumers.

UK Deep Dive

The NSC’s UK Deep Dive – as well as the numerous other country deep dives produced across 2024 – give in-depth insight into the ways people shop (76% of UK consumers plan their salmon purchases for example), the ways in which they cook (dry heat is most popular for cod, though men and young people tend to opt for fried).

It looks at the emotional attachments they have to these meals (salmon is cited as an ‘opportunity to relax’ by 35% of respondents) and who they are eaten with (64% say their last cod meal was eaten with their partner). These surveys cover pretty much everything you want to know about the ways consumers think about, plan, buy and eat their seafood.

But what does all this look like in the real world and in the real kitchens of those doing the thinking, planning, buying and eating?

We went inside the homes of three different consumers to find out what motivates them, what they look for in the seafood choices and how well they fit the consumer mould.