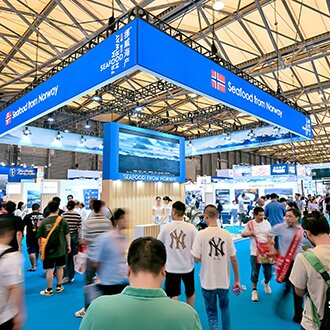

China is the world’s largest gross exporter of seafood and also ranks among the top ten consumer nations globally, with an annual consumption of 41.6 kg per person. The Norwegian Seafood Council is represented in Shanghai by our envoy Sigmund Bjørgo and market advisor Savindar Xie.

In 2024, China imported seafood worth NOK 195 billion, equivalent to 4.5 million tonnes. Norwegian exports to China have grown by double-digit percentages annually over the past decade (except in 2020), reaching NOK 9.4 billion or 182,000 tonnes in 2024. Salmon is by far the largest species in Norway’s seafood exports to China, followed by mackerel.

China’s middle class is expected to grow significantly over the next five years. Combined with technological development and increased e-commerce, this presents major opportunities for Norwegian seafood going forward.

Norwegian Salmon Exports to China

The market for Atlantic salmon in China totaled 129,000 tonnes in 2024, with Norway holding a market share of 45 percent. The main competitors are Chile (23 percent) and Australia (12 percent). Norwegian exports have seen strong growth in recent years, and this trend is expected to continue.

Norwegian salmon holds a solid position among Chinese consumers, with the highest awareness among salmon-producing countries. Sales are primarily through HoReCa (85 percent), but the share of e-commerce and home delivery is increasing.

The Seafood Council is actively working to strengthen origin labeling in retail and is conducting targeted marketing toward selected segments to position Norwegian salmon as the best choice for raw consumption.

Exporting to China requires strict veterinary standards, and Norwegian salmon is subject to tariffs that competitors do not face. The Seafood Council maintains close dialogue with the Norwegian Food Safety Authority and keeps exporters updated on regulatory changes.

Norwegian Mackerel Exports to China

China’s mackerel market is dominated by Pacific mackerel, with a volume of 360,000 tonnes, while Atlantic mackerel accounts for 10,000 tonnes. Norway is the leading supplier of Atlantic mackerel with a market share of 70 percent. Iceland (11 percent) and the United Kingdom (5 percent) are the main competitors, with Iceland benefiting from zero tariffs.

Approximately 15–20 percent of Norwegian mackerel is consumed in China, while the rest is re-exported after processing. Around 65 percent goes to HoReCa, primarily Japanese restaurants, but there is growth in the premium retail segment and e-commerce. Norway is the only country with a notable degree of origin labeling.

It is important to strengthen loyalty to Norwegian mackerel among Japanese restaurants and to map the complex value chain to create strategic partnerships that can support further development in the Chinese market.

Market Plans for China